Katherine: It is good to talk with you, Andrew. Before we get into this very interesting market for uranium, please tell us about yourself.

Andrew: It's a pleasure to talk to you, Katherine, as well as your audience at the Streetwise Energy Report. My background and experience is diverse, but I'll summarize the key areas. My formal education was in business, finance, and history at university. My initial career started in 1999 within the construction industry servicing primarily energy infrastructure on hydroelectric projects with a period of managing contracts with various U.S. government agencies, among other clients.

I'll mention a key client of Berkshire Hathaway Energy; I've worked with these folks. Today I remain to be a consultant of a long-time client of mine, and they serve a very specialty segment within the heavy construction industry on the energy side. I'm originally from Oregon but moved away about ten years ago to pursue other opportunities overseas.

In 2012, I decided to start an investment research group that had an interest in numerous areas of the markets, eventually narrowing down that focus to the junior natural resource sector in 2015. We've been here ever since, establishing an impressive network within the junior sector as well as some good performance along the way.

About SmithWeekly Research

Katherine: Tell me about SmithWeekly Research. What do you do there?

Andrew: SmithWeekly Research does a number of interesting things that revolve around the junior natural resource sector. That is our focus area. We are differentiated and distinct, which I'll support with a few points. We perform research, form a view, and then act on that work by investment. We wrap this all together in the form of a written letter and model portfolio, which we provide to our membership, which is a wide demographic of market participants who are receiving our work.

As any experienced allocator would, we must take care of our positions by constraining them but also by concentrating them, as well as managing cash at all times. Remember, this is a model portfolio that we treat like a fund.

The broken nature of the uranium market is the most compelling at this time, and we see the uranium market is among the best commodity cases, if not the best.

As you know, Katherine, there are the so-called newsletter services out there that don't do any respectable job of actually managing cash or controlling positions, which any sophisticated investor or fund would do on their own. Our membership is currently waitlisted, but we encourage anyone serious to contact us to get on that list for when we open up to new members.

We also do a small amount of work on the awareness side, which is effectively a networking tool for us, but we do manage a very simple and non-promotional podcast called SmithWeekly Discussions, that enables some very basic research and idea generation, as well as providing entertainment and education to a general audience.

The group also provides business strategy consulting work within the junior sector on a select basis. Our consultant side is active, and we are delighted to review your needs as long as it falls within our work scope. Lastly, being overseas in various jurisdictions over the last ten years has put us in a position to provide substantial experience with a strategy called internationalization, which is something that every successful person should become aware of because it carries notable benefits and a global perspective formed by a multi-jurisdictional approach. So without further explanation, that is SmithWeekly.

Focus Area: Uranium

Katherine: Interesting, and what specific commodities are you currently focused on?

Andrew: The large majority of our focus is currently on uranium, of which we've been working since 2016. For reference, back then, the price of uranium was about US$18 per pound. More on that later.

Additionally, some resources are allocated to company-specific opportunities in copper, gold, and related areas of the market due to our extensive network of people we know in the junior sector. For us, the broken nature of the uranium market is the most compelling at this time, and we see the uranium market is among the best commodity cases, if not the best.

Katherine: I'd like to get into uranium with you now. Unpack that for me?

Andrew: There is too much to cover just in this conversation, so let me get to the key points about the setup, but still, your readership will want to settle in and get out the note-taking materials, ok?

Now, first, let me establish my experience in the sector. We know the sector very well, and I don't say that from a point of arrogance; there is already enough of that in the sector. We don't proclaim to be experts or professionals, but we've done the work, we know all of the meaningful people who matter, and we know all of the meaningful companies.

With any junior sector, there are a lot of fakes and promotes that we just don't have the time for. They are incidental. We were among the very few who actually showed up at the very starting line of this sector back in 2016. When we say we've done the work, we first started on two fronts: data gathering and networking. There is a lot of publicly available information out there about the sector; all you have to do is take the time to sort it all out.

We did this on the supply side, gathering up figures on primary supply, secondary supply, the costs of that supply, each mine, operating mines, mine closures, mine restarts, development projects, secondary supply dynamics, and all of the things you would need to evaluate as a serious analyst that is incentivized by your own capital. This provides the pieces to the puzzle to see a larger picture of where the supply side is, what the schedule is, what the costs are, and those important parameters.

The marginal producer will set the uranium price for this cycle. Why? Because the marginal producer is the one that can start backfilling demand due to special circumstances like lead time and because they are in a position, in a development sense, that brings on meaningful production, filling a big bite of demand.

Then you are forced to dive into the fuel cycle to understand conversion, enrichment, and fabrication because the fuel cycle impacts in different ways the uranium mining side. Pricing, capacities, and even things like jurisdictional alignment are important. Then we went to the demand side last because we already knew that demand was there and that it wasn't being turned off.

We did the same thing here, compiling reactor consumption, utility lists, retirement schedules, immediate-term new builds that were in their advanced construction stages that we knew would be finished, plus some other considerations that are for our internal consumption only.

All of our work remained conservative, on the side of worst-case scenarios. Then we performed the supply and demand comparisons against factors like term contract timing, price incentive, development timelines, and even people factors. We were very pleased with the results, favoring concentrated investment, to put it lightly.

Next, we networked in all of the key areas to confirm or debate the results. Everything was done from scratch. In our networking efforts, you also get to form a baseline view of the different characters that you are working with. This is important later on down the road for establishing patterns and a record to classify these different people. You meet good people, and you meet a lot of bad actors. That is the junior sector.

Ok, so that is the backdrop that people need to understand when establishing credibility in doing the work. We don't pump our chest about it like others; we are humble people.

Everyone has an Excel spreadsheet, but the differentiator is the quality of work that goes into them. Many people in the sector, including many CEOs of listed companies, still haven't actually done the work.

What does that tell you?

Lazy, among other things, come to mind. The arrogance and intelligence level of many management teams that prevails today is laughable. They often say, "We know everything."

The reality is often the opposite, and it should be well noted if you hear those words. The more time you spend working in the sector, the more obvious it becomes. Now this is not to be confused with the real people in the sector that do real work. We also find the sector fascinating still today from many angles that aren't key to this discussion, a conversation for another time.

The uranium market is the most niche and obscure segment of the junior sector. Uranium itself is the feedstock for commercial nuclear reactors. These reactors are the last to be impacted by changes in energy demand, crises, and changes in economic cycles. There is no substitute for uranium; it has a very strong moat. There is no substitute for nuclear power at this time, and its only competitor is its bigger brother, fusion power, which won't replace the existing reactor fleet in any meaningful time frame important to us.

The uranium price will move higher to incentivize new project development. The majors alone don't have the ability to fill this market. The next tier, being juniors, must be called upon, and the lead times are not being comprehended.

Fusion has a long way to go to prove commercial feasibility, then actual commercial deployment, and then is ramped up to a replacement rate that impacts the current fission fleet. The problem with uranium is that there is a limited amount of expertise to successfully pull it from the ground, process it, drum it, and get it delivered to the conversion facility. There is no shortage of uranium in geological terms, only a lack of expertise, capital, economics, and infrastructure to lift it from ground to cake in a can.

The uranium sector is very small in terms of listed equity capitalization, being around US$40 billion in aggregate, consisting of majors, a few mid-tiers, juniors, listed funds, ETFs, and some service providers. This covers explorers, developers, producers, fuel cycle service providers, and some special situations. Our data today suggests about 119 companies are in the sector, up from probably 50 when we first started.

To be clear, we are not discussing the broader commercial nuclear industry in this, only the uranium segment. Such a tiny beat-up sector provides a critical service to the highest density and highest quality energy source invented so far in human history, harnessing nuclear fission and putting a steam turbine with it. Look, it is best that I spare you the broader commercial nuclear energy thesis, as everyone beats that drum, and I am just not interested in repeating myself on that front. We've done that and have moved on.

Primary supply cannot respond as fast as demand is improving. That is the reality. Stronger prices for longer must occur to start to solve the supply problems. Layer on the fact that the sector doesn't have many competent people. This isn't the gold or copper sector as an example; it is the uranium sector. This is a low-level radioactive material with additional care and specifications required.

Mining gets harder at every turn. Building new mines is harder than it was ever before on price, talent, specifications, requirements, timelines, and regulatory red tape such as permitting. Then there is reclamation and mine closure — so many things to keep track of. Incentives must eventually be satisfied for the sector to become healthy again. Prices drive that incentive. On the production front, many will fall short of their stated goals. So many of these promises, economics, fancy slide decks, and hopeful production are swimming naked. Cost escalated, and they are in further trouble. Many companies trying to reach production will fail.

We like everything that Cameco is doing in this market, and they are supporting better pricing and a healthier market going forward. Cameco is a great choice for safer money that needs capable hands.

Our work leads us to the conclusion that the marginal producer will set the uranium price for this cycle. Why? Because the marginal producer is the one that can start backfilling demand due to special circumstances like lead time and because they are in a position, in a development sense, that brings on meaningful production, filling a big bite of demand.

Much is still needed to get to this point, but the marginal producer and developer, if successful, is needed to satisfy utilities. Based on our data, we expect that marginal producer incentive figure to be about US$85 per pound on a global average, cost escalation adjusted, plus or minus a few bucks. Increasing costs seem to stick around longer than anyone thinks, and often they don't go away.

A few years ago, that number was lower. Then the price has to stay there for a notable period of time. Nothing meaningful gets done on a spike. The upcycle we are in was facilitated by supply discipline in the latter years, layered on with a decade of poor pricing that cleansed the sector. Add during that time a period of slower growth for the commercial nuclear industry, supply flood from secondary supply in the form of excess capacity, and demand cuts arising out of Japan taking reactors offline post-Fukishima.

You have consistent 430-odd reactors in operation today. Yes, there are a few more, but some are in temporary outages or permanent shutdowns. More are coming online each year, whether new builds or restarts. This is firm and dependable. Let's call uranium demand about 200 million pounds per year, fuel cycle bottleneck, and assay adjusted, with a conservative margin. Add that capacity in the fuel cycle is very constrained. Layer in a price-supportive event with the Russian invasion of Ukraine because Russia-influenced and controlled suppliers are so important to the smooth functioning of the fuel cycle, not to mention uranium production from those sources. The West is looking to marginalize Russia as punishment for its actions. It will take many years to transition away from Russian fuel cycle services because the West lacks the infrastructure to do so.

We see demand rising notably over the next few years, falling in line with a contracting cycle that is both replacement rate plus additional inventory add to backstop the uncertainties occurring on the supply side, add geopolitical motivations.

The Supply Side

Katherine: Thank you. That is a lot of information here for our readers to digest. What about the supply side at this point?

Andrew: Yeah, good question. Let's move into that. The fuel cycle leads the uranium market in terms of up and to the right. Because capacity is maxed out in the fuel cycle, prices are rising, and the line out the door is down the street and around the block. Capacity expansion will, again, take years and will need capital commitments demonstrated through long-term service contracts at attractive prices to justify capacity expansion.

In the meantime, secondary supply, which is a result of the underutilization of capacity, has essentially been eliminated from this current market. Secondary supply will return in the future, but not in the time frame we care about. Because capacity is full, to speed up meeting client demands and specifications, efficiencies reduce uranium utilization when performing enrichment, meaning more uranium is now used because there is less focus on minimizing manufacturing losses.

This is part of tails assay adjustments, a mix of specifications with inputs based on underlying prices of the fuel cycle parts such as UF6 or uranium hexafluoride, SWU or separative work unit, and with the end result being EUP or enriched uranium product. Fuel cycle prices lead the uranium price in an upcycle. It is important to provide this context, and I am leaving out some more complex details, but nothing that is negative to the thesis, for time and simplicity. I'll give your readers homework to go back and look at the price improvements in the fuel cycle since 2016 to help paint the picture that capacities are constrained with no immediate solution.

Now, the supply side now stands at about 127 million pounds in production. We expect a slight increase this year to that number as some restart operations in U.S. ISR and at Cameco's McArthur River make progress. 200 and 127 million pounds respectively, demand-supply, you do the math, means that the sector is in deficit.

Everyone knows that, or should know that, by now. The solutions to that deficit are where the struggles are manifested. Nothing gets solved on a light switch flip.

In fact, so far from it, you'll need binoculars to see it because it is far off. The deficit has been with us for a couple of years. The deficit will stay for a number of years on a go-forward basis. Price, time, and lack of many things tell us enough. It only gets closed with new build mine production. Existing uranium production capacity cannot support closing the deficit by itself.

To get new builds back to the marginal producer, higher prices are required. Let's not forget to mention the depletion of good mines that will come to pass by the late decade. Those pounds need to be replaced, but it will take years to do so with capital and price being in line. Nothing in the immediate term fixes the supply problems.

We know term contracting is here to stay for a number of years ahead of us. Term contracting volumes so far this year are on pace to set a record for this cycle, we figure at least 150 million pounds will be transacted this year conservatively, and we have years of the same still to go.

Where does the supply come from?

It won't come in the way that you would expect. It will be delayed and challenged throughout the entire time. Projects will fail, transportation will be difficult, and permitting and environmental will slow things or stop them. Operatorship is in decline, and mining opponents are on the increase. Quality people are getting older, and they are not being replaced.

Deep Yellow has one of the best opportunities to get into production against its peers, of which many won't get into production or will have severe challenges along the way.

Without the marginal producer and potential new producer being incentivized, which means a suitable price point for a suitable period of time with suitable contracts to backstop capital expenditure, bank financing, etc., there won't be enough production centers online to meet the demands of global utilities.

To repeat ourselves, this is a problem of price; this is a problem of capable expertise to successfully put cake in a can and deliver it under commercial terms to the conversion facility. As I said, there is no shortage of uranium in the world being in the ground; there is a shortage of viable projects with capable people and capital to deliver into that demand.

Just recently, the junior equities have been, on average, about 60% off their October 2021 highs. The underlying uranium price has remained robust while the equities drown, some for good reason, mind you. This is an allocation point. To wrap this up for you and your audience, Katherine, and we've left out some other important areas of discussion for the sake of time, I'll say the following. We are in a term contracting cycle that will demand more pounds than can be supplied.

The uranium price will move higher to incentivize new project development. The majors alone don't have the ability to fill this market. The next tier, being juniors, must be called upon, and the lead times are not being comprehended. We covered a lot of the important areas, let's stop there, and I think we've demonstrated the broken nature of this market.

Uranium Exposure Methods and Mentions

Katherine: What about the investment side? How are you getting exposure?

Andrew: For us specifically, only the junior equities make sense to us. Not the majors, not ETFs, not physical funds. We understand the junior sector, and as a result, we are very comfortable there and don't need the normal risk reduction that the other vehicles provide. We evaluate individual equities, so we don't need the ETFs. Individual junior equities packaged into a concentrated and well-constructed portfolio, such as a mix of key jurisdictions and various stage companies, result in the best leverage and performance by far. We don't bother ourselves with any other type of exposure as it is most likely inferior to the route we've positioned with.

Katherine: Any specific companies that you can share with our readers?

Andrew: Well, I need to be careful here, respecting the work provided to our members at SmithWeekly, that also I do not know the specifics of your readership demographic, and because we've been in the sector from the lows, our cost basis is likely lower than yours. I can mention a few that interest me with the understanding that your readers must do their own work. I need to add further context and caution your readers further on a few other points to set the stage with the right view.

To your readers, they need to understand the dynamics of the junior market, which I don't have time to discuss nor provide education on today, but very important that you understand the junior markets, cyclicality, high-risk nature, and all of the components associated with that are needed to navigate the junior sector. We're also not at the start.

This cycle has been in progress since we entered the equities back in 2017, one year after our research started, with the underlying uranium price already on the move, from about US$18 per pound back then to around US$55 today.

Meanwhile, the junior equities are at their third major low point for the cycle, the first being 2016-2017, early 2020, and now again this year, as of a few months ago. Higher highs and higher lows are clearly in place over this period. We are likely at the last point of entry from an allocator's perspective, and eventually, the value proposition will stop.

I'll give you some company ideas throughout the entire risk and stage spectrum. That means lowest risk to highest risk, producer to explorer stage. I'll be brief for the sake of time, and that all require work from your readers. Let's start first with the blue-chip of the sector, uranium mining and fuel services provider Cameco Corp. (CCO:TSX; CCJ:NYSE), which is the largest publicly traded nuclear fuel services provider that covers the uranium mining side through the fuel cycle.

Through its proven Tier 1 assets, Cameco has the reputation of being the preferred supplier for nuclear utilities globally. Cameco is down streaming its business, through the partial acquisition of Westinghouse, to take advantage of challenges in the fuel cycle plus the bifurcation that is developing in the market as a result of the war in Europe.

We like everything that Cameco is doing in this market, and they are supporting better pricing and a healthier market going forward. Cameco is a great choice for safer money that needs capable hands. Led by Tim Gitzel and Grant Isaac, these are two of the most competent leaders in the business. They are very intelligent guys, and your readers should take note to hear often from them.

Katherine: And how about the junior side?

Andrew: Now we are moving up the risk profile into the developer juniors; I'll mention Deep Yellow Ltd. (DYL:ASX), a Namibia and Western Australia-focused project developer advancing two uranium deposits toward production over the next few years. The team is best in class with respect to actually building out mines and successfully putting cake in a can.

This team, led by John Borshoff, was among a few juniors who actually built mines and produced in the last uranium cycle. The company at the time was called Paladin Energy, which still exists today but is under a different management team whom we continue to be unsure of, and a company that is about half of its former self in terms of assets. Our information supports that Deep Yellow has one of the best opportunities to get into production against its peers, of which many won't get into production or will have severe challenges along the way. The team is older at Deep Yellow, which presents some unique risks, but we are very satisfied with the technical, operational, financial, and all-important factors at the company. The team is very competent. The readers need to hear from John whenever he speaks publicly. I like John and his approach.

Another interesting developer-stage company is EnCore Energy Corp. (EU:TSX.V; ENCUF:OTCQX). Encore is restarting two ISR facilities in South Texas, United States. Encore has two more development projects, one in South Dakota and one in Wyoming, as part of a longer-term pipeline project strategy.

We understand the company will be producing uranium at the two restarted ISR facilities over the next 12 to 18 months, which, upon full ramp-up, will put them in a cash-flowing condition. Since the company hired Paul Goranson in 2020, the business has become a great success because his expertise backfills the productive assets and provides the increased comfort that it is operationally viable with Paul at the helm. Paul is the competent person to lead the company to cake in a can. Paul is a fantastic guy.

Over in Australia, keep an eye on Alligator Energy Ltd. (AGE:ASX) and Boss Energy (BOE:ASX), two companies that are developing projects at very different stages mind you, in South Australia. In Canada, watch Denison Mines Corp. (DML:TSX; DNN:NYSE.MKT), the most likely successful project developer there, and they have a lead time head start over peers.

The Exploration Side

Katherine: What about the exploration side of things? This is always the place that investors tend to go to at some point.

Andrew: Yes, the junior food chain ends at the exploration side, and as a cycle moves, so do investors coming down into the high-risk, small company end of things. Juicing the risk profile higher and to a level that is speculative and very dangerous, I'll mention some very small exploration stage ventures.

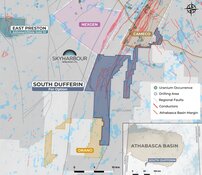

Cosa Resources Corp. (COSA:CNSX;COSA:CSE) has a recently successful exploration team that discovered the Hurricane uranium deposit east Athabasca Basin in 2020. Once the initial discovery was successful, the team departed and then started to work to put together a new startup that would focus on the east Athabasca area again, which is the better part of the basin due to existing infrastructure and the bulk of productive capacity being in the region.

The goal is to repeat. The projects are green as it gets exploration, but we think the potential for a good outcome is among the best in the basin. Steve Blower and Andy Carmichael are the lead exploration expertise there and have proven their abilities just a few years back. We also think the CEO there, Keith Bodnarchuk, has good potential in the sector going forward. Again, very high risk, and there are no drill holes yet, so not for the faint of heart. Be careful.

To finish off on speculation and dangerous risk, we also think Puranium Energy Ltd. (2DK:FRA;UX:CSE) and their focus on Namibia uranium exploration is compelling from a potential discovery standpoint within a proven uranium mining district. The size of the company, along with the capital structure, aligns well with the exploration focus. This company is one of two very small explorers focused here. That is a small number for such a proven district.

They are looking for the same paleochannel calcrete hosted deposits that other successful operations, like the Langer Heinrich mine, are based on. From our review currently, the value of their exploration grounds alone is worth more than their current capitalization. We think it fits well in the speculator category as the cycle progresses. Again, not for the faint of heart, do your own work, and be careful, but it fits our other end of the strategy well.

There are others that should deserve an endorsement, but for the sake of keeping some work with members only and for the sake of time, let's cut it here. To be clear, again, the companies mentioned here are not to be construed as something that is for you, the readers. These are my interests right now; they are what I like; you need to do your own work and find your own conclusions. We've not received anything from these companies for our kind mention.

It is our work only; please do yours.

Experts To Follow

Katherine: Thank you, Andrew. What about other people in the sector you've not mentioned? Are there any other people that you'd like to mention that would be good for our readers to follow?

Andrew: Oh, sure, there are. Let me expand some more. With respect to the older and long-time participants that are meaningful to us in this sector, wisdom transfer this cycle will be very important before they exit the sector for good. Wisdom transfer is often forgotten. Ok, to some of the people that I think of, Dustin Garrow, a key industry veteran that runs a consultancy on all things uranium. He has exceptional expertise in what he does, and we can only hope to learn what Dustin knows in our short time in the sector compared to his. He is a professional and has a lot of integrity. Listen up if you hear from him.

Just a bit more on Grant Isaac. He is considered younger in the sector but has a tremendous amount of knowledge and is cut out to be a real leader in this business for decades to come. He is well-spoken, knows his stuff, is confident, and he gets away with it. Pay attention to Grant.

As mentioned before and worth mentioning again, John Borshoff must be on your radar. His competency in the sector is unique and should not be underestimated. He tells it like it is and can do so because he has the resume to back up his words. His abilities, from exploration to operatorship, are proven. John is top shelf.

As I said before, Paul Goranson is a wealth of knowledge. He is sincere, highly respected, and is a proven operator. I like Paul, and he is a good man. Ron Hochstein, although he is not fully engaged in the uranium sector right now, is a proven operator and is regarded among the best in my book. If you can hear from Ron, although he doesn't often talk about uranium, take all you can get from him. His credentials are exceptional; he is solid.

With respect to overall sector events, insights, analysis, and even a service that is actionable, Justin Huhn at Uranium Insider is worth your time. Justin has the pulse of the market, and his work satisfies many types of investors.

When it comes to events and breaking news in a unique way, John Quakes on Twitter is absolutely a source to keep up with. John is creative and provides a unique service nobody has matched.

Edward Sendrea, if you can find him, is a very well-connected strategist and investor in the sector. He has been in the sector as long as we have and is very well-tuned into key areas on M&A, investment, investigation, network depth, and much more.

Marcelo Lopez at L2 Capital knows the sector very well and has a very good understanding of individual equities. He is a smart guy and has integrity.

Mart Wolbart out of Europe, with his sector analysis and actionable service, is worthy of attention. Mart has come up to speed very quickly and is successful.

There are many others that I will miss here as I think. Gill Swaby at Deep Yellow is a seasoned company strategist. Greg Hall at Alligator Energy, John Cash at Ur-Energy, Brandon Munro at Bannerman Energy, Duncan Craib at Boss Energy, Dave Cates at Denison Mines, and Jeff Geringer, who provides fuel cycle and utility expertise, all very capable people in certain respects within this sector. I know I missed some good people here; forgiveness is appreciated.

What To Avoid

Katherine: Great, a lot of detail and names. What should be avoided here?

Andrew: Well, thanks for asking, as it is important too. There are many things to avoid, and it starts with rolling up your sleeves and getting your hands dirty. We don't have time in this conversation for all of that, but I will come back to people. In terms of people, on the other side, as to be expected, there are a lot of people to avoid that make up the waste of the sector.

A lot of capital gets destroyed here. Self-enrichment, lifestyle companies, entrenchment, dumping entities, and many other unmentioned atrocities and terms come to mind. Now I won't mention specific names for obvious purposes. They know who they are anyway. Eventually, discovery happens, and they get pointed out when the tide goes out. I'll come back to what I said at the start about establishing patterns and, subsequently, a record to profile these people. This sector, like the broader junior natural resource sector, has a lot of grease and less than reputable people.

Be careful here. Some of the institutions in the sector are very egocentric and overly self-serving, but their utility has diminished over the years as they have been studied. Most of them won't talk about actionable detail and generally stick to a broader script. Everyone has made mistakes in the sector, including them. We're happy to admit that we have made mistakes; we are human, just like all of the people in the junior sector. Treat them as such; they are not to be placed on a pedestal.

There are a lot of promoters out there. Too many of them. We need an honest junior sector, but sadly that isn't the case for many of them. Many of them are overpaid with little to no credentials. Instead of real mining to serve a critical industry in a responsible fashion, they get their kicks by mining the shareholders instead. They don't talk about this at the cocktail parties. We try to stay away from these greased actors, but at some point, any natural resource investor will get caught in a crappy company at some point along the way. The used car salesman grease eventually gets our capital at least once.

There is a learning and experience curve here. The sector doesn't have many competent people. Don't take my criticisms of the bad people and the bad companies wrong; this is all very reinforcing for the investment thesis because it points out the so few that actually hold the productive capacity of the sector together. To really identify the people to be avoided, you really need to do a lot of work and cross-examine them with others because they go to great lengths to conceal themselves and to dress up their companies. You'd be enlightened to another world. Some of these people don't like us, and we just don't care.

On this subject matter, related, I need to mention something else. People should be careful with junior natural resource social media. While useful for certain things, there are good connections to be found, and we understand the utility. You have to manage properly and trim the noise. There are many stooges on these social platforms, so don't waste your life away. Better things to do elsewhere.

What is the Exit?

Katherine: Very good insights. Andrew, what is the exit, as that ultimately has to be done at some point?

Andrew: Look, we aren't going anywhere yet. We've spent a lot of time internally constructing, reviewing, and revising our exit planning. With due respect to our work and our members, I can't share those details, but anyone who wants those details should become a member. Our most recent revisions to our planning are in review now. We've got a good amount of time yet, and the broad market fears have extended the runway for our time in this sector. We will be looking closely at things like prices, term contract volumes, productive capacity, new capacity that we are confident will be built successfully, valuations, and a few other metrics and events that we consider important about the decision-making. We can't share those at this time; sorry about that. The cycle eventually ends, and you must prepare accordingly to make that prudent exit.

Katherine, now we will remain in the broad junior sector. Our work and relationships span the whole business, from people, independents, brokers, banks, traders, service providers, corporate back office, analysts, and so much more. We understand the business. We understand the risk, the performance profiles, and all of the things that matter to be successful. Uranium will always be special to us, nonetheless.

Katherine: This has been a fascinating conversation, Andrew. Thank you for the time and for deciding to speak with me on the Streetwise platform.

Andrew: I am confident that your readers will find this conversation very useful or at least entertaining. My regards to you and the team. Thank you, Katherine.

Ownership and Share Structure

According to Reuters, the majority of Cameco's shares are held by institutional investors (73.04%). Fidelity Management & Research has 4.82%, with 20.88 million shares. The Vangaurd Group Inc. has 3.42%, with 14.83 million. Capital World Investors has 3.30%, with 14.28 million. Mireae Asset Global Investments has 3.17%, with 13.71 million, and William Blair Investment Management has 2.36%, with 10.24 million.

0.39% is held by management and insiders. President and CEO Tim Gitzel has 0.09%, with 0.37 million shares. Executive Vice President and CFO Grant Isaac has 0.06%, with 0.27 million. Senior Vice-President and Chief Corporate Officer Alice Wong has 0.05%, with 0.20 million, and Senior Vice-President, Chief Legal Officer and Corporate Secretary Sean Quinn has 0.04%, with 0.16 million.

0.01% is with strategic investor Power Corporation of Canada, with 0.03 million shares.

The rest is in retail.

Market Watch reports that Cameco has a market cap of CA$17.7 billion, with 433.03 million shares outstanding. It trades in the 52-week range between CA$26.32 and CA$42.22.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Cameco Corp.

- Katherine DeGilio wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.

As of the date of this article, I, Andrew Weekly, individually own securities of ALL companies discussed in this article.

SmithWeekly Research Disclosures

SmithWeekly Research IS NOT a financial advisor, tax professional, broker, or legal advisor. SmithWeekly Research is a publisher of financial opinions and educational content. All information, data, strategies, reports, articles and all other features of our products are provided for informational and educational purposes only and should not be considered or inferred as personalized investment advice and is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. We are researchers that provide opinion and commentary. We are not licensed professionals. You must enlist the services of properly licensed accountants, legal counsel, brokers, agents, and all other required professional services needed to help you make your decisions for your own situation. You should never act solely upon single party opinion or commentary. Certain US regulations prohibit us from giving personalized investment advice or other advice whatsoever on a personal basis. SmithWeekly Research does not accept any form of compensation whatsoever from companies or assets that we may research and write about. SmithWeekly Research does not recommend or endorse any brokers, dealers, or investment advisors. SmithWeekly Research's reports, writings and other media releases are based on its opinions, current news & events, interviews, corporate news & reports, SEC, SEDAR, other regulatory filings, and any other information learned from sources and experiences. Research may contain errors, and you should not make any financial decision based solely on what you read in SmithWeekly Research’s reports and writings. It’s your money, it’s your responsibility to perform your own due diligence, and you must make your own decisions. Be advised and aware that buying and selling financial instruments involves risk. We accept no liability whatsoever for any direct or consequential loss arising from any use of our writings, products, services, website, or other content. You are responsible for your own investment research and decisions. You should seek the advice of a qualified investment advisor and fully understand any and all risks before investing. Historical results of our products are no guarantee of future results. We make no representation that you will or are likely to experience similar results. All results of our recommendations are not based on actual buying and selling of securities. All results are based upon a hypothetical model portfolio. Hypothetical model portfolio results have limitations and do not reflect all components of actually buying and selling securities. Your actual results may vary based upon many factors. All content and references to third-party sources are provided solely for convenience. This information may be inaccurate, use at your own risk.